The mill poured 7,055 ounces in the third quarter, and those ounces generated gross proceeds of $33 million Canadian

Canada, 9th Oct 2025 – Global Stocks News – Sponsored content disseminated on behalf of West Red Lake Gold. On October 7, 2025, West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) provided a Q3 update on the ramp-up of the Madsen Mine located in the Red Lake Gold District of Northwestern Ontario, Canada.

In an October 8, 2025 YouTube video, West Red Lake Gold VP Communications, Gwen Preston, explained the significance of the Q3 ramp-up update.

Fiore Group companies are renowned for hiring top-level talent to liaise with shareholders. Preston holds an undergraduate degree in science and a master’s degree in journalism. Prior to her appointment at WRLG, she was the CEO of Resource Maven, a senior financial writer and a veteran public speaker.

“West Red Lake Gold just put out a mine-site update discussing what we’ve achieved in the last three months at the Madsen mine,” explained Preston in the YT video.

“We’re being methodical in our approach, working to increase daily tonnes mined and moved, while also completing the last few projects needed for the site to operate consistently as planned.”

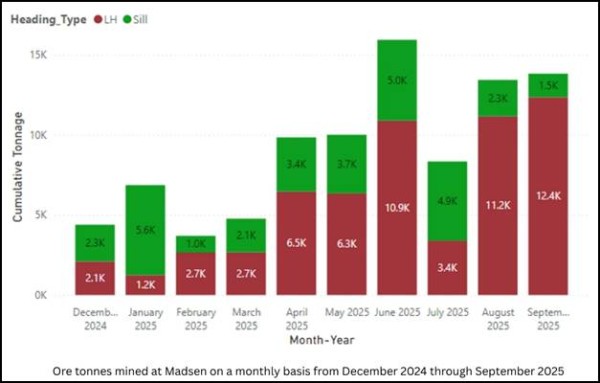

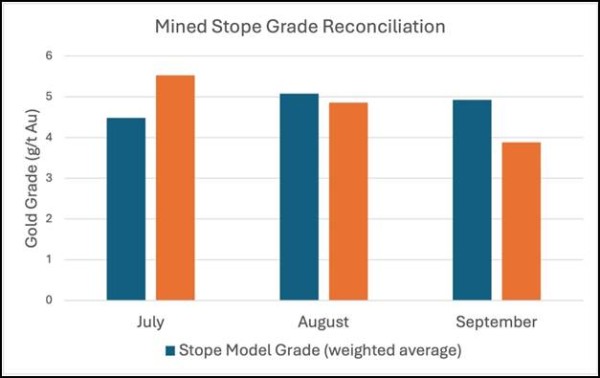

“Let’s talk about the numbers. In the third quarter, the Madsen mine produced 35,700 tonnes of ore, and those ore tonnes carried an average grade of 5.4 grams per ton gold.”

‘The mill poured 7,055 ounces in the third quarter, and those ounces generated gross proceeds of $33 million Canadian. For context, that production is 34% more in the third quarter than what we produced in the second quarter, which was when we did our bulk sample and had our first five weeks of ramp up.”

“We expect to maintain this pace of increase, 35-40%, somewhere in that range, into the fourth quarter,” said Preston. “Doing that would get us to our targeted output levels in time for our goal of declaring commercial production early in 2026.”

“The primary ramp-up factor at Madsen, the critical path item, is increasing daily mined ore tonnes. It’s important to understand that for every tonne of ore that’s hauled out of the mine, 1-2.5 tonnes of waste rock is also mined and has to be managed.”

“Until recently, all of that waste rock was trucked up to surface. So each day, about 500-1,200 tonnes of waste rock was trucked out of the mine. That took up a lot of trucking capacity. It was a significant development a few weeks ago when we started storing all of our waste rock underground.”

“In the middle of September, we quite abruptly started storing all of our waste rock underground. We saw the benefit immediately. In the second half of September, the mine moved over 1,000 tonnes of ore a day on several occasions, including a record day moving 1,400 tonnes of ore. This shift bodes well for production ramp-up in the fourth quarter.”

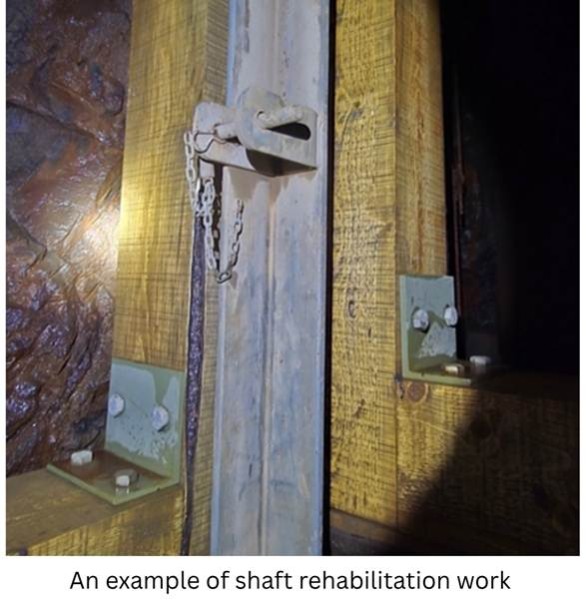

“There’s another infrastructure project that will add a similar benefit to that underground waste storage project, and that’s the shaft,” stated Preston. “A historic shaft at Madsen goes all the way down to 1,300 meters. At the end of last year, we rehabilitated that shaft down to about 600 meters on the 12th Level.”

“In the middle of the year, we determined that we could use it for skipping material. So we ordered the hoist components needed to get that underway. We expect those to show up and be installed by November, when we should be able to start moving 350 tonnes of ore up the shaft each day.”

“At about 500 meters depth, to get a truck from there out the portal takes about an hour. You can see why we’re keen to get the shaft operating, to be able to move tonnes at a better efficiency and lower cost.”

“I also want to explain the rationale for our recent financing,” continued Preston. “We’ve said since starting up the mine that we believe we have the capital and cash flow to complete the ramp-up of Madison as planned. That remained true even as we announced the financing.”

“So why did we do it? Accessing additional capital now gave us the ability to pull a ventilation project and a power project forward. Starting these projects imminently, instead of waiting until mid-2026, creates the potential for us to produce more ounces at Madison sooner.”

“West Red Lake Gold was founded, and is still very much driven by the investment thesis that the best way to get leverage to a gold bull market is with rising gold production in a junior company.”

“We decided that it was best for our investors to prioritize this forward-looking work, to bring in additional capital now, to do more sooner. The additional capital will help us get deeper sooner.”

“If ramp-up remains smooth and the gold price remains at these phenomenal levels – it touched $4,000 an ounce this morning – we will end up with additional capital, we will use that to pay off our pay down debt sooner, so that we can increase our free cash-flow.”

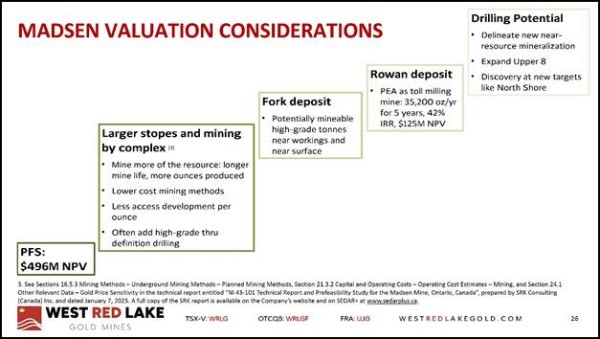

“We think that that’s a valuable goal to chase for our investors. Lastly, the flow through capital will help us advance Rowan to pre-feasibility level by mid-2026. That’s important, because it keeps Rowan on track to be in construction in 2027 or 2028, depending on permitting.”

“In the coming months, I’m keen to start talking more about Rowan. It’s a great project that we’re pushing ahead with quickly. Adding 35,000 ounces a year to our production profile in just a few years, we think, is a particularly significant thing to do,” concluded Preston in the explainer video.

The Madsen deposits presently host an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold within 6.9 Mt and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold within 1.8 Mt. [1 .] [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for technical disclosure at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

References:

- “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada”, prepared by SRK Consulting (Canada) Inc. and dated January 7, 2025 (the “Madsen Report ”). A full copy of the Madsen Report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:35128

The post Video Enhanced West Red Lake Gold Books Q3 Gold Sales of CND $33 Million as Mine Ramps Up appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Marketwise Analytics journalist was involved in the writing and production of this article.